Insurance

Take the Risk out of the Risk Management

In the insurance industry, safety and risk management are the bedrock of sustainable business practices. Investing in comprehensive risk mitigation not only minimizes potential liabilities for insurers but also fosters trust among clients.

By prioritizing safety, insurers not only protect their financial interests but also contribute to the overall resilience and stability of the industry, ensuring that policyholders receive the dependable coverage they expect in an ever-changing and dynamic risk landscape.

Get Started Now

Why YellowBird should be a part of your business’s safety culture:

Customized Risk Mitigation Strategies

Develop tailored risk management plans based on the specific needs and operations of clients. Implement proactive measures to address identified risks and minimize potential losses.

Regulatory Compliance

Ensure clients remain in compliance with industry regulations and legal requirements. Keep clients informed about changes in regulations that may impact their risk exposure.

Loss Control Inspections

Conduct on-site inspections to identify potential hazards and recommend improvements. Help clients proactively address issues to prevent future losses

Claims Management and Support

Assist clients in the efficient and effective management of insurance claims. Provide support throughout the claims process, from filing to resolution.

Premium Reduction Strategies

Work with clients to implement strategies that may lead to lower insurance premiums. Recognize and reward clients for effective risk management practices.

Examples of Insurance Industry Services:

Loss Prevention Assessment

A Loss Prevention Assessment is a comprehensive evaluation conducted by professionals to identify and mitigate potential risks and vulnerabilities within a business, aiming to prevent financial losses and enhance overall security measures.

Safety Walkthrough

A Safety Walkthrough is a systematic inspection of a workplace or facility conducted by safety experts or personnel to identify and address potential hazards, ensuring compliance with safety protocols and promoting a secure environment for workers.

OSHA 300 Training

OSHA 300 Training involves educating employers on the record-keeping requirements outlined in the Occupational Safety and Health Administration (OSHA) 300 Log, ensuring accurate and compliant documentation of workplace injuries and illnesses.

Build a Program with YellowBird

Your in-house safety or risk specialist can’t be in multiple places at once. But with YellowBird Pros nationwide, you can build your program at scale with ease. Control how your organization manages EHS and Risk Management with YellowBird.

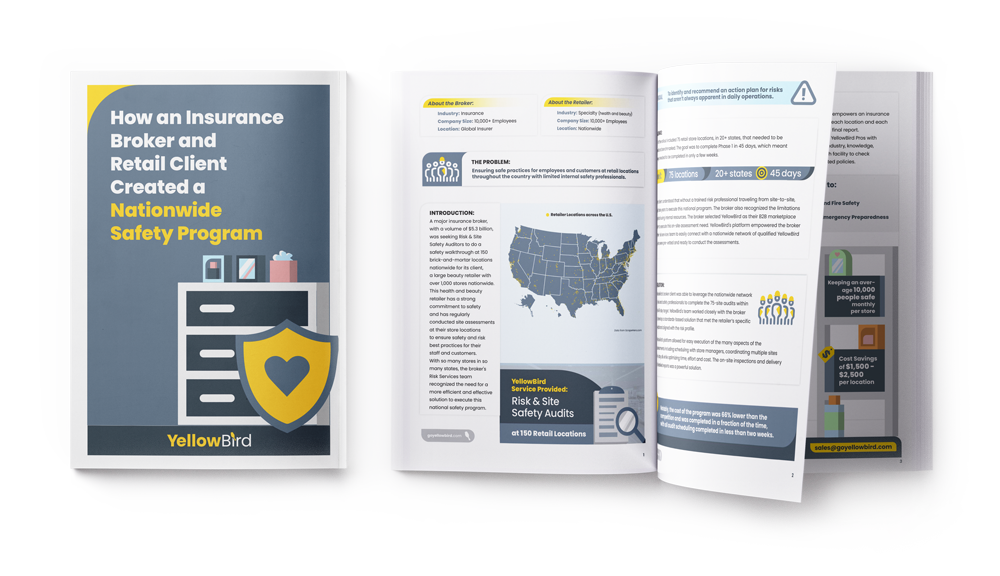

Build a Safety and Risk ProgramHow a Multi-Billion Dollar Insurance Broker & Major Retailer Created the Safest Solution

Boost Your Insurance Business Now: Download Our Case Study on Leveraging YellowBird’s Risk Management Solutions

YellowBird is becoming the go-to in Construction Safety across the nation.

Insurance Related Blogs

Don’t see what you’re looking for?

We know that all organizations have room for EHS and Risk Services. Explore our extensive services.

Explore EHS Services

Schedule a meeting with us.

Insurance FAQs

How does YellowBird address loss prevention?

YellowBird Pros can provide best practices for preventing accidents, minimizing liability, and implementing measures that reduce the likelihood of insurance claims.

I’m a national insurance company, how can your services benefit us?

Consider putting together a loss prevention program to maximize your budget and minimize your spending, learn more about our programs.

I’m an independent broker, how can your services benefit my clients?

The size of your business doesn’t matter, everyone’s safety does. YellowBird is proud to work with insurance companies of all sizes.

What are the most requested services for the insurance industry?

Loss prevention, safety manager, OSHA300, Mock OSHA inspections, safety walkthroughs, IH assessments

The YellowBird Pro Community is growing every day. If you’re an EHS or Risk Services Pro looking for flexible work opportunities, Register Today as a YellowBird Pro to get started.

Control Your

Hours

Work Jobs That

Interest You